Posted on: 29th January 2026

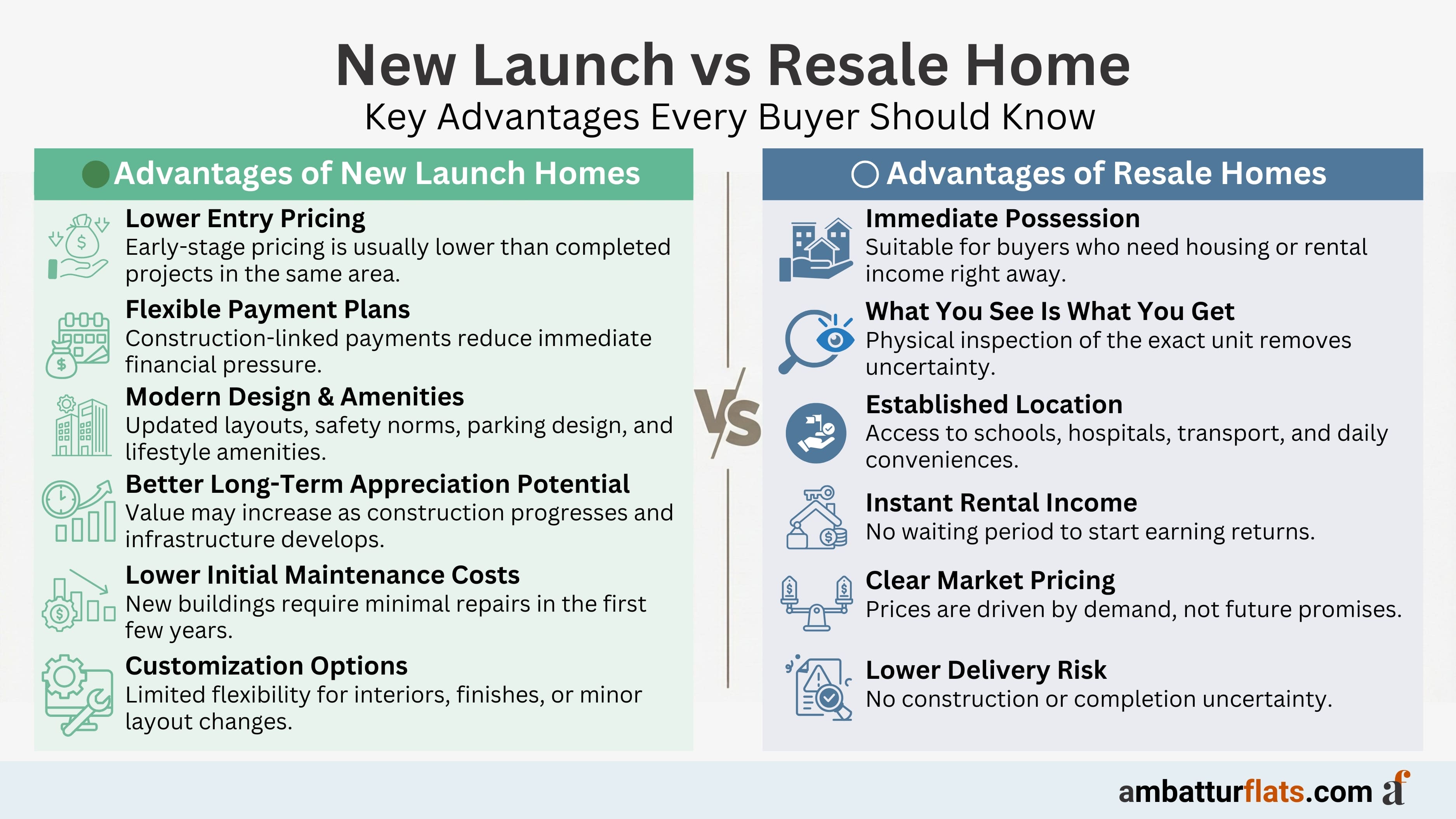

Buying a home is one of the most important financial decisions most people make. One of the first questions that arises in this process is whether to choose a new launch property or a resale home. Both options have their own advantages, limitations, and risks. The right choice depends on factors such as budget, urgency, long-term plans, and risk tolerance.

This article offers a clear, structured comparison to help buyers make an informed decision. Instead of promotional claims, it focuses on practical realities that buyers face during and after purchase.

| Aspect | New Launch Property | Resale Property |

|---|---|---|

| Stage of Construction | Under construction or recently launched | Already built and occupied |

| Price | Usually lower at the launch stage | Market-driven, often higher upfront |

| Payment Structure | Construction-linked or flexible plans | Full payment or standard home loan |

| Possession Timeline | Future date, subject to delays | Immediate or short-term possession |

| Customization | Limited layout and finish choices | Fixed structure, minor changes only |

| Maintenance Costs | Lower initially | Depends on building age |

| Legal Due Diligence | Requires careful verification | Clearer history, but still essential |

| Rental Potential | Low until possession | Immediate rental income possible |

| Tax Benefits | Benefits start after possession | Benefits start immediately |

| Risk Level | Higher due to delivery uncertainty | Lower if documents are clear |

A new launch property refers to a project that has recently been introduced to the market, often at an early stage of construction. Developers typically promote these projects with introductory pricing, flexible payment plans, and modern amenities.

One of the main attractions of new launch projects is pricing at the entry stage. Early buyers often get lower rates compared to later phases. This can result in better capital appreciation if the project is delivered on time and the surrounding area develops as expected.

Another benefit is modern design and infrastructure. New projects usually comply with current building norms, safety standards, and urban planning regulations. They often include features such as better parking layouts, power backup, rainwater harvesting, and shared amenities designed for current lifestyle needs.

Payment flexibility is also a key advantage. Many developers offer construction-linked payment plans, which reduce the immediate financial burden. Buyers pay in stages rather than arranging the full amount upfront.

The biggest concern with new launch properties is delivery risk. Delays due to approvals, funding issues, or construction challenges are common. Even with regulatory frameworks in place, timelines are not always predictable.

Another issue is the lack of immediate usability. Buyers cannot move in or earn rental income until the project is completed and handed over. This can affect cash flow planning, especially for investors.

There is also limited clarity during the early stages. Show flats and brochures may not always reflect the final product. Buyers must rely heavily on documentation and the developer’s track record.

A resale home is a property that has already been constructed and owned by someone else. These homes may be occupied or vacant at the time of sale.

The most practical advantage of a resale home is immediate possession. Buyers can move in soon after completing the transaction or start earning rental income right away. This is especially useful for those who need housing urgently.

Resale properties offer greater certainty. What you see is what you get. Buyers can physically inspect the unit, assess natural light, ventilation, neighborhood quality, and actual carpet area.

Another benefit is established surroundings. Schools, hospitals, markets, and transport links are usually already functional. This reduces dependency on future development plans.

From a financial perspective, home loan approval is often smoother because the asset already exists and has a transaction history.

Resale homes usually require a higher upfront payment. Sellers expect payment within a short timeframe, leaving little room for staggered payments.

Older properties may also involve higher maintenance costs. Plumbing, electrical systems, elevators, and common areas may require repairs or upgrades.

Legal verification can be complex if ownership has changed multiple times. While risks are lower than under-construction projects, careful document checks are still essential.

Most buyers focus heavily on the quoted price per square foot, but this number rarely reflects the true financial commitment involved in buying a home. Whether it is a new launch or a resale property, several additional costs significantly influence affordability and long-term value.

In new launch projects, the advertised price is often only the starting point. Buyers usually encounter multiple add-on charges that increase the final cost:

In addition to these visible costs, buyers should also factor in interest outgo during construction. Home loan EMIs often begin before possession, which means the buyer may be paying rent and EMI simultaneously for an extended period.

Resale homes typically come with a higher upfront ticket size, but the cost structure is more transparent.

Key expenses include:

While these costs may appear high, resale buyers avoid GST and prolonged interest payments during construction. In many cases, the total cost difference between a new launch and resale property narrows significantly once all expenses are considered.

Legal due diligence is essential in both scenarios, but the nature of risk differs.

For under-construction or newly launched projects, buyers are effectively committing to a promise rather than a finished asset. Legal verification must focus on the project as a whole, not just the individual unit.

Important checks include:

Since the project is incomplete, buyers rely heavily on paperwork and regulatory compliance. Any lapse at this stage can result in prolonged delays or legal disputes.

Resale transactions involve an existing asset, which reduces uncertainty but does not eliminate legal risk.

Buyers must verify:

Although resale properties offer better visibility, older transactions may carry legacy issues if documentation was not properly maintained. A thorough review remains essential.

When viewed as an investment, new launch and resale properties behave differently in terms of risk, return, and predictability.

New launch properties can generate strong returns if several conditions align:

However, these returns are speculative rather than assured. Delays, oversupply, or slow area development can lock investor capital for years without meaningful appreciation.

Additionally, the absence of rental income during construction increases holding costs. Investors must be prepared for a longer gestation period and higher uncertainty.

Resale homes offer stable and measurable performance. Rental demand can be assessed immediately, and cash flow begins soon after purchase.

Appreciation may be slower compared to early-stage projects, but the risk profile is more balanced. Established neighborhoods provide demand stability, especially for mid-range housing.

For conservative investors or those dependent on rental income, resale properties often provide better risk-adjusted returns.

For end users, the decision often goes beyond financial metrics and into everyday living experience.

New projects are designed around contemporary lifestyle preferences. Buyers often value:

However, these benefits may take time to materialize. Even after possession, amenities may not be fully operational immediately, and the surrounding area may still be under development.

Resale homes provide immediate clarity on living conditions. Buyers can evaluate:

Older buildings may lack modern amenities, but they often compensate with better locations and larger usable spaces.

Financing plays a critical role in overall affordability, and the structure differs notably between the two options.

For under-construction properties, loans are disbursed in stages based on construction progress. While this reduces initial EMI amounts, it extends the repayment timeline.

Buyers often pay pre-EMI interest without reducing the principal, increasing the total interest paid over the loan tenure. Any construction delay further extends this phase.

In resale transactions, loan disbursement usually happens in one or two tranches. EMIs begin immediately and contribute toward principal repayment from the start.

This structure provides clearer financial planning and avoids prolonged interest-only periods. For salaried buyers, this predictability often improves long-term affordability.

Exit flexibility is often overlooked during purchase but becomes critical later.

New launch properties may face resale restrictions until possession and registration are complete. Market demand at exit depends heavily on project delivery quality and surrounding development.

Resale properties, especially in established areas, usually offer better liquidity. Demand is easier to assess, and pricing benchmarks are clearer, making resale decisions more predictable.

The decision between a new launch and a resale home should be based on facts, not assumptions. Each option serves a different type of buyer and purpose. By understanding the trade-offs clearly, buyers can avoid common mistakes and make a choice that remains practical even years after the purchase. A well-informed decision today reduces stress, financial strain, and regret in the future.