Updated on: 21st January 2026

Many homebuyers are usually new to the venture of househunting. The President of CREDAI Chennai states that the majority of homebuyers in 2025 belonged to the age group of 28-45. Even rational and smart homebuyers can easily fall into traps if they don’t follow a checklist when buying a house. This checklist will help them to gather all the key factors to consider, evaluate, and analyze before choosing to buy a property. We have come up with a list of key checks every homebuyer must consider when they choose to buy a house or any property. Let us tick the list one by one!

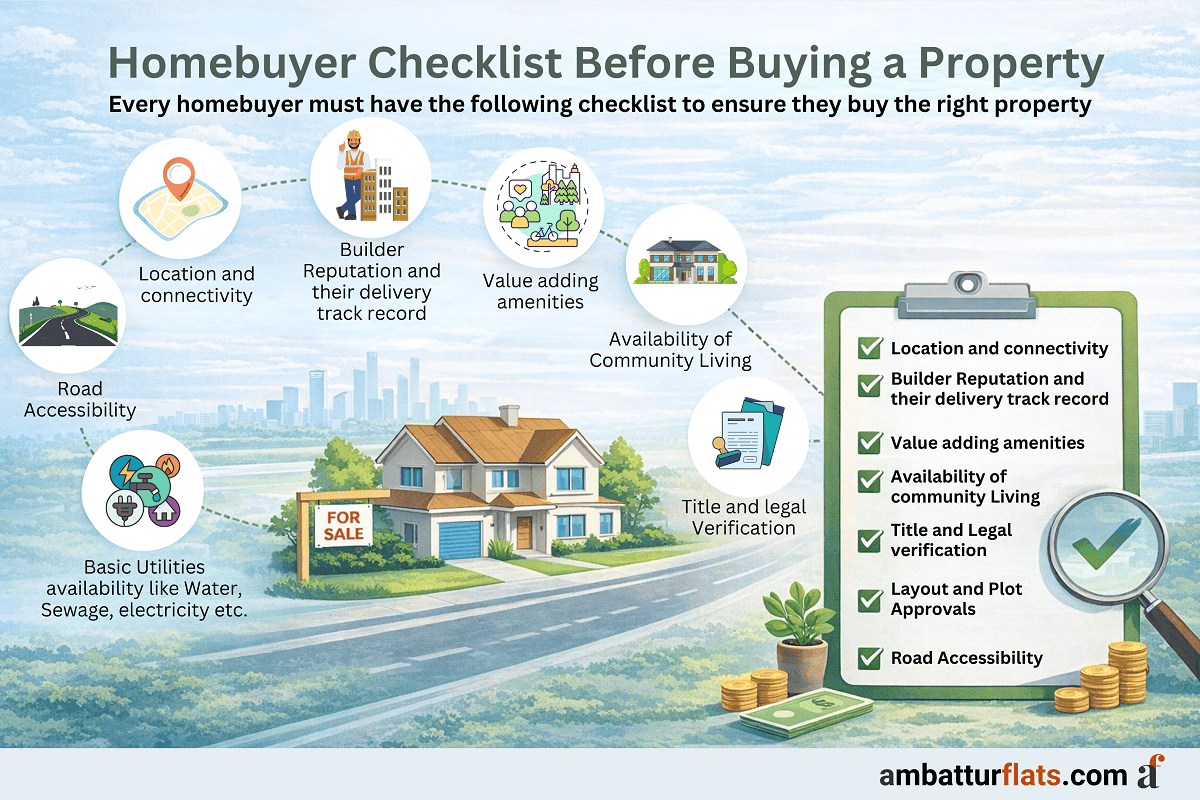

Every homebuyer must have the following checklist to ensure they buy the right property:

These are the necessary things you must check and evaluate before you choose a property for buying. Let us now understand the key aspects to consider in each of these checks.

Location is the first and foremost thing you must consider when choosing a property. It plays a key role in property value and convenience. Connectivity is also linked with your property location.

The area or neighbourhood you choose to buy your house must be located near major transit infrastructure, such as metro stations, highways, and arterial roads that tend to attract consistent demand. Easy access reduces daily travel time and improves livability for residents.

Another important aspect is access to social infrastructure. Schools, hospitals, workplaces, and shopping zones influence both rental demand and resale prospects. Therefore, the location of your dream house must be in a locality that easily connects you and provides you with all the basic infrastructure.

Check out the major real estate hotspots in Chennai.

The credibility of the developer has a direct impact on risk exposure. A strong track record often reflects consistency in delivery timelines, construction quality, and post-handover support.

Buyers should review past projects completed by the builder. Key points include delivery delays, construction complaints, and structural issues reported after possession. Site visits to older projects can reveal how well the property has aged.

Legal compliance is another critical check. Every residential project must be registered under the Real Estate (Regulation and Development) Act (RERA). Buyers should verify the project’s RERA registration number, approval status, and disclosures available on the official portal.

Amenities have become an important factor for deciding on a property since they support the daily needs of residents. Many residential projects now include gyms, childcare zones, co-working spaces, walking tracks, and shared open areas. These features contribute to convenience and reduce the need to travel for routine activities.

Amenities also influence community interaction. Projects that encourage shared usage tend to create stable residential ecosystems, which support resale value.

Neighborhood quality plays a major role in price stability and resident retention. A well-planned community offers shared infrastructure such as internal roads, drainage, security, and recreational areas. These features reduce dependence on external services and improve living conditions over time.

Clear ownership is the foundation of a secure purchase. Buyers must verify the ownership chain to confirm that the seller has legal rights to transfer the property.

Important documents include:

Any unresolved disputes or inconsistencies should be clarified before proceeding.

Every residential project must have approved layouts from the relevant planning authority, such as DTCP, CMDA, or local municipal bodies.

Key documents include:

Unapproved layouts often face registration rejection or future demolition risks.

The physical accessibility of the house you are going to buy is very important, and many people forget to consider this during their househunting venture. Every homebuyer must check:

These are basic utilities that every resident expects, and when this is unavailable, there are several disadvantages to it.

Registrar and RERA data show that a noticeable percentage of property registrations are rejected due to missing approvals or incomplete infrastructure documentation. So, it is necessary to verify these facilities before proceeding with confirmation.

Property prices do not rise uniformly. Major infrastructure projects such as airports, metro corridors, and expressways influence appreciation patterns. These areas have better price growth that increases your property value over time.

Areas near upcoming infrastructure may see short-term volatility but often deliver stronger long-term gains once projects become operational. Buyers should align their investment horizon with development timelines.

Holding capacity is another factor. Maintenance costs, taxes, and loan obligations should be manageable even during slower market periods.

Exit potential depends on the buyer profile. Typically, end-user-based markets tend to offer more stable exits than investor-heavy zones.

As a homebuyer, you must consider these factors, whether you are buying for personal use or as an investment.

Buyers who approach the process with structured checks and realistic expectations are better positioned to make decisions that remain sound well beyond the purchase date.