Posted on: 18th February 2026

Gifting a house to your spouse sounds straightforward and thoughtful. Many people assume transferring property to a wife reduces tax liability or shifts income into a lower tax bracket. In reality, the tax treatment is far more complicated.

In India, transferring immovable property between spouses involves income tax provisions, stamp duty costs, clubbing rules, and long-term capital gains implications. The transfer itself may be tax-free, but the income generated later often remains taxable to the original owner. This gap between perception and reality is where most mistakes happen.

Before taking a decision that involves lakhs or even crores of rupees, it is essential to understand how the law actually treats such transfers.

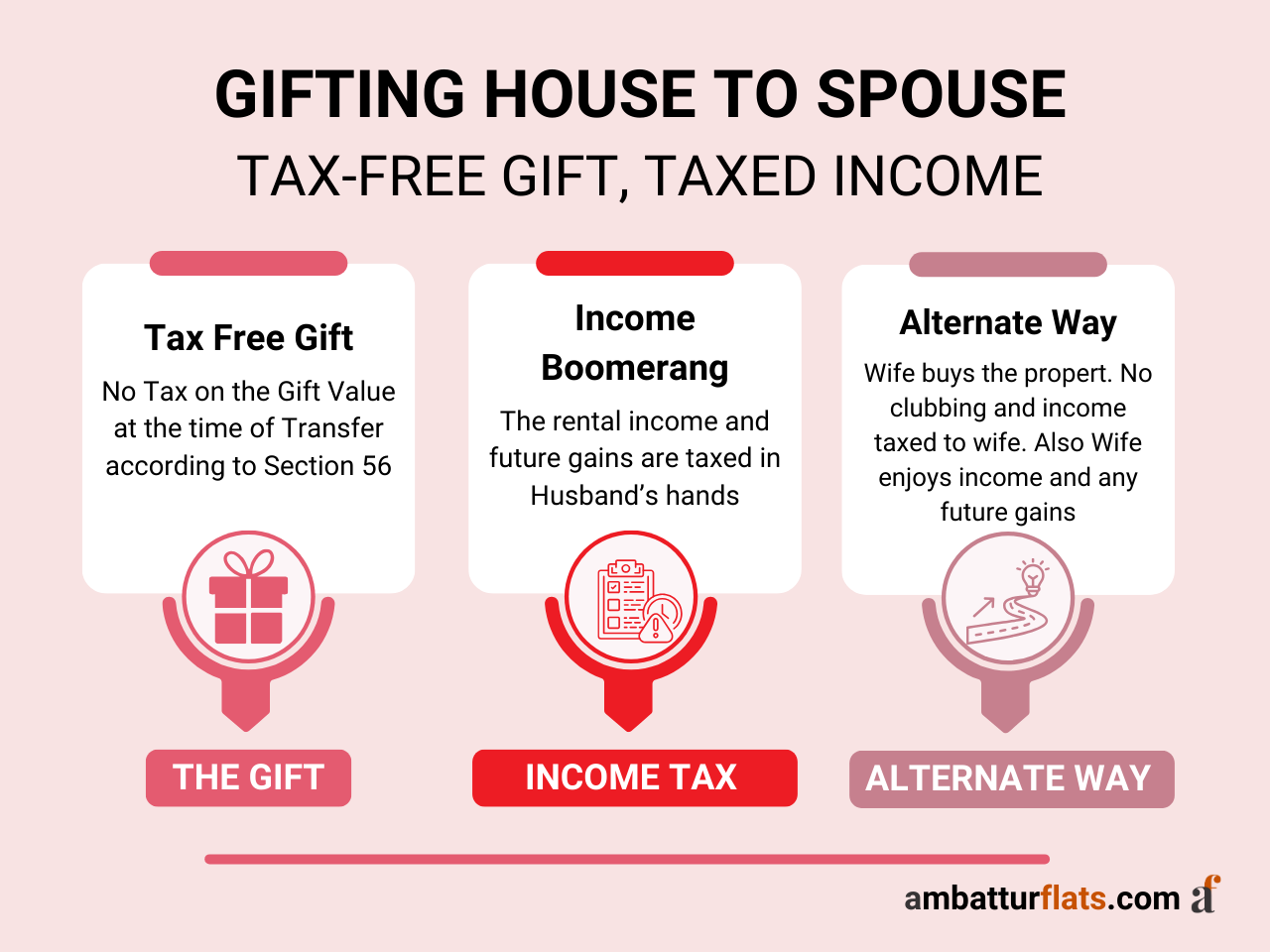

The Income Tax Act allows tax-free gifts between specified relatives, and a spouse is included in this definition. Under Section 56(2)(x), a wife can receive property from her husband without paying tax on the value of the gift, even if the property is worth ₹1 crore or more. There is no upper limit on the value of such gifts.

At the time of transfer, there is also no capital gains tax. The law does not treat a genuine gift as a taxable transfer. This creates the impression that gifting property is financially efficient. However, this exemption applies only at the moment of gifting. The moment the property starts generating income or is eventually sold, a different set of rules begins to apply.

This distinction is critical. The gift may be tax-free today, but the financial consequences continue long after the transfer.

Section 64 of the Income Tax Act contains the clubbing provisions. These rules were introduced to prevent taxpayers from transferring assets to family members purely to reduce tax liability.

When a husband gifts property to his wife without receiving payment, any income generated from that property is treated as the husband’s income for tax purposes. The law assumes that the transfer could be used to move income into a lower tax bracket, and it blocks that possibility.

If the property is rented out, the rental income is added to the husband’s taxable income every year. Even if the property is legally in the wife’s name and the rent is credited to her bank account, the tax liability still belongs to the husband.

The same rule applies when the property is sold. Capital gains are taxed in the husband’s hands, not the wife’s. This creates a situation where ownership and taxation do not match. Legal ownership changes, but tax responsibility does not.

Gifting property does not eliminate capital gains tax. It only postpones it.

When the wife receives the property, she also inherits the husband’s purchase price and holding period. This means the tax calculation continues from the original purchase date.

Consider a practical example. A property purchased for ₹50 lakh appreciates significantly over time. After indexation, the cost becomes ₹80 lakh. If the wife later sells the property for ₹1.5 crore, the long-term capital gain becomes ₹70 lakh. This gain is taxed in the husband’s income tax return at the long-term capital gains rate of 12.5%.

The key takeaway is simple. Gifting delays taxation, but it does not remove it.

While income tax may not apply at the time of gifting, the legal transfer of property still requires registration. A gift deed must be executed and registered with the appropriate authority. This process involves stamp duty and registration charges that vary by state.

Stamp duty can range from about 3% to 8% of the property value. On a ₹1 crore property, the transfer cost can run into several lakhs. Many people focus only on income tax and ignore this immediate expense. If gifting is done purely to save tax, the stamp duty alone may outweigh any perceived benefit.

This upfront cost is one of the most practical reasons to think carefully before gifting property.

When the clubbing rules and transfer costs are considered together, gifting property to a spouse rarely reduces total tax liability. Rental income remains taxable to the husband. Capital gains remain taxable to the husband. Transfer costs must be paid upfront.

From a purely tax perspective, the transaction often creates additional expenses without delivering meaningful savings. This does not mean gifting is always a bad decision. It simply means tax savings should not be the primary reason.

Despite the tax limitations, gifting can serve long-term planning goals. Estate planning is one of the most common reasons. Transferring property during one’s lifetime can simplify inheritance and reduce the risk of disputes in the future.

Gifting can also defer capital gains tax when a property has appreciated significantly. For example, a property purchased for ₹20 lakh that is now worth ₹1.5 crore would trigger substantial tax if sold today. Gifting postpones this tax until a later sale. The total tax remains the same, but the payment is delayed. The time value of money makes deferral useful in long-term financial planning.

Clubbing applies only to income directly generated from the gifted property. It does not apply to income generated from reinvested income.

If rental income from the property is taxed to the husband but the wife invests that income in mutual funds, the returns from those investments are taxed in her hands. Over time, this allows income to gradually shift within the family.

This is not an immediate tax benefit, but it becomes meaningful over long periods.

A genuine sale between spouses is treated differently from a gift. If the property is sold at fair market value through proper banking channels, the clubbing provisions do not apply.

After the sale, rental income and future capital gains belong to the wife for tax purposes. This approach often achieves the outcome people mistakenly expect from gifting.

The key requirement is that the transaction must be genuine and properly documented as per the registration process.

Another structured approach involves funding the purchase through a loan instead of a gift. The husband provides funds as a loan at a reasonable market interest rate, such as 8%. The wife uses the loan to purchase the property in her own name.

The husband declares the interest income in his tax return, and the wife becomes the genuine owner of the property. Because the transfer is not a gift, clubbing provisions do not apply. This method is widely used in financial planning.

Tax deductions related to home loans depend on who pays the loan, not just who owns the property. If the husband continues paying the EMIs after gifting the property, he remains eligible for deductions. Interest deduction is capped at ₹2 lakh per year under Section 24(b), while principal repayment qualifies for a deduction up to ₹1.5 lakh under Section 80C.

The wife can claim these deductions only if she makes payments from her own income.

Gifting a house to a spouse feels straightforward, but the tax consequences are complex and often misunderstood.

The key realities are clear:

A property transfer is a major financial decision. It should be guided by planning and facts rather than assumptions. Understanding the tax rules before transferring ownership can prevent expensive mistakes later.